Although much of the news nowadays consists of tariff bids and talks, there's still a lot of uncertainty about what that might look like, especially when it comes to our beauty products.

This is especially the case now that President Donald Trump has temporarily reduced U.S. tariffs on Chinese imports from 145% to 30%, according to NBC News. While this agreement might've eased some tension, you might still have concerns about whether or not your favorite makeup or personal hygiene product will drastically increase in price.

Beauty brands also feel some uncertainty, too. During my research, very few brands wanted to speak out about the tariffs (after all, the ever-changing updates don't make the answer very clear). Though the topic is sensitive for some, if not most, it's evident that it's still too early for brands both large and small to predict what the next few months will look like.

To get more clarity on the subject, we reached out to experts to get some guidance on what you can actually expect from tariffs. And from the beauty brands that were open to comment, they provide a glimpse of their game plan, including how they're reassuring panicked customers. Plus, what to buy now.

Will beauty products will be affected by tariffs?

The short answer is yes, and products aren't the only thing that will be affected. According to a press statement from the Personal Care Products Council, which represents more than 90% of the beauty industry, “The cosmetics and personal care products industry is a key driver of the U.S. economy, with over $68 billion in U.S. manufacturing and 4.6 million U.S. jobs,” along with over $300 billion being contributed directly to the nation’s GDP. Thus, this signals that all beauty categories will be directly or indirectly affected by the rise in tariffs to some degree.

While price jumps are a concern, Jason Miller, a professor at the Broad College of Business at Michigan State University, notes that there will be a reduction in "the variety of goods that the American consumer can expect," too. "What will happen is sort of marginal items, maybe the non-bestsellers — those are the first ones that start dropping if there are price increases taking place.".

That means beauty brands based outside the U.S. and/or that source overseas (which includes U.S.-based brands) will see the most impact, as foreign brands that were once bestsellers for their price and formula, might be pushed to the side. So the K-Beauty sunscreen you love? It might no longer be under $20. Your favorite fragrances? They'll be hit, too.

"We rely on imported inputs to make these products, even the ones manufactured in the United States," Miller adds. "The tariffs on those imported inputs essentially counteract any ability to make the domestically produced goods more cost competitive because you’re paying the tariff on the imported inputs, and then having to raise your price as a result of your costs going up."

While many hair, makeup and skin care products can be manufactured in the U.S., not all products are able to achieve a specific quality domestically. This why why many brands turn to overseas manufacturers. In fact, Investopedia reported that South Korea, France, Italy, Canada and China were the top five countries that supplied beauty products into the U.S. in 2024.

Miller has some reassuring words as we find out more about the effects of tariffs.“There are possibilities that the price increases won’t be too too bad, but more importantly, we’re waiting to see what happens with the reciprocal tariffs and what those rates are."

Should we stock up on beauty products now?

While it may be tempting to click checkout on all of the items in your shopping cart, there’s no need to panic-buy now. Depending on the brands you rely on, it’s best to wait on their response.

"For consumers who have staple products from Asian beauty brands, or favorites that rely on trend-driven limited editions, it could be practical to stock up now before potential price hikes take effect," says Esther Olu, a cosmetic chemist, licensed esthetician and instructor. "Additionally, smaller brands with less flexibility in absorbing or offsetting costs may increase prices sooner or reduce SKU [product] availability."

Olu adds that some brands "may absorb short-term cost increases to retain market share, while others may reformulate or adjust packaging to mitigate the impact." So, for consumers, it's best to stay aware of "brand updates, formulation changes and pricing patterns" instead of panic-buying, as we all "should responsibly take heed of expiration dates and their general consumption patterns."

Beauty products that may be affected by tariffs

Shopping expert Trae Bodge expects "U.S.-based brands will maintain their price points if they can," as they'll become more competitive compared to important brands. So if your favorite brand is U.S.-based, such as Eos, you can take a breath for now.

However, there is always a chance that U.S.-based brands may raise their prices on top-rated products if foreign competitors do, too. But we won't know the impacts for a few months.

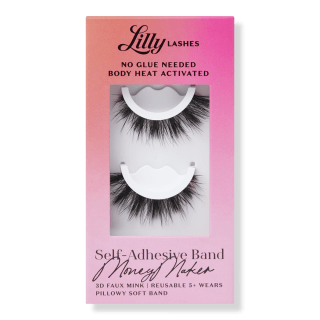

False lashes can save time and boost confidence, but they oftentimes have a learning curve. These recently launched lashes from Lilly Lashes have a self-adhesive black band that doubles as eyeliner for tons of volume without the hassle of glueing.

Sabeen Mian, President of Performance Beauty Group’s Lash Division, notes that the "the tariff situation is one that impacts my team specifically because a lot of the business that we do is out of Asia, and so none of the production, yet, is in the U.S." Although her clients design domestically, "our lashes are made of Korean PBT, which is a material manufactured in China," she adds, where lash production is also a hub.

"Those kind of production capabilities that I saw when I was visiting Qingdao [China] just doesn’t exist in the U.S. today. So made in America eyelashes would be something that isn’t a short-term or even medium-term possibility," Mian says.

This award-winning hair growth serum from affordable Canadian beauty brand The Ordinary might look different in terms of cost over the next few months. Alongside China, Canada has also faced tariff wars with the U.S., and currently is up 25%.

But according to Investopedia, the United States-Mexico-Canada Agreement, which President Trump signed in his first term, should exempt makeup and skin care products from tariffs.

Compared to other beauty categories, it's likely that Asian beauty, such as K- and J-Beauty, will be the most impacted by the U.S. tariffs. Although CosRX and many other Asian beauty brands haven't confirmed yet, it's likely they'll see price increases.

Olu shares that these brands thrive "on rapid product development (i.e., high product turnover), high-quality formulations and global exporting." With tariffs on raw materials, packaging and more, it affects "this ecosystem by increasing production cost" and limits "access to international markets," she continues.

"For consumers abroad, especially in the U.S., tariffs often translate to higher retail prices, reducing the competitive pricing advantage that K-beauty is well known for," Olu adds.

Since Nudestix does not manufacture their cosmetics in China, the brand hasn't been significantly impacted by the larger tariff challenges. "However, there are components/packaging parts that may be made in China that have suddenly had a massive increase in cost," the co-founders, Jenny Frankel and Taylor Frankel, told us. "Our immediate action was to pause production for a few weeks until we felt confident that there were no more tariff changes, as we would not want to pay the highest tariff if we suspected that, in a few weeks, the tariffs would be lowered."

A recent Reddit post went viral after a cosmetic chemist claimed that the cost of sunscreens will most likely go up. Dr. Shuting Hu, a cosmetic chemist and founder of Acaderma says this might be "because some raw materials are manufactured in China" and Europe due to "lower manpower cost and mature industry supply chain." That includes ingredients like avobenzone, homosalate, octisalate and octocrylene, some of which this La Roche-Posay sunscreen contains. Another impact is packaging, as "most of the tubes for sunscreen products are made in China," continues Hu.

While it isn't clear if La Roche-Posay manufactures some of its products in China, they identify as a French pharmacy brand. Currently, the U.S. has imposed a 10% baseline tariff on the EU, per Politico.

"Part of what makes us unique and authentic to the brand is that our products are made in India," says the brand's founder, Michelle Ranavat. This includes their highly-rated saffron-infused serum. "That is something that we would not change ... I think this is just a time where you really have to double down on your values."

Currently, the U.S. has imposed a 10% base tariff on India, but recent news reveals that India is open to closing the tariff gap on U.S. goods, per Reuters.

CEO of Dr. Loretta, Gina Ciraldo Stabile, spoke with Beauty Independent about the impacts of tariffs on her business. "We manufacture the goop in the U.S., but source all of our packaging from overseas," she told the publication. "The U.S. simply doesn’t have the manufacturing infrastructure or labor cost structure to be able to manufacture packaging at an affordable price." She added that the brand is currently searching for sourcing outside of China.

Your favorite hair extensions, whether done at home or in the salon, are at risk of a potential spike, too. "Extension companies are vulnerable since many source their hair from China," explains David Thurston, a salon owner and the founder and CEO of Danger Jones. "Many big brands have already raised prices during the inflation period, and now there’s growing worry they’ll pass on the added cost of tariffs. Since a lot of them are publicly traded, I’d expect they eventually will."

Zala uses 100% human hair for their extensions, according to their site, and ethically sources from Eastern Europe and Asia, which currently have high tariffs imposed.

Like France and the rest of the EU, the U.S. has a 10% tariff placed on Italian goods. Armani Beauty comes from the Italian fashion house Armani, which makes all of their makeup and skin care products in France and Italy, based on product pages.

While we love the fruity-floral aroma inside Chanel's Chance spray, there is a risk that it, alongside the fragrance industry, will have to make price adjustments because of tariffs.

"The average fragrance house may have hundreds or thousands of ingredients that are regularly restocked, that go into tens of thousands or hundreds of thousands of customer SKUs, and these ingredients can cross multiple borders before arriving in consumers’ hands,” said Alex Wiltschko, the CEO and founder of fragrance research company Osmo, to Glossy.co. That doesn't include the cost of bottles and more.

Dr. Howard Sobel, a cosmetic dermatologic surgeon, says we can expect tariffs on LED beauty products, too, such as this Shark CryoGlow face mask. "However, how much will depend on whether the ingredients and/or packaging are sourced from outside the U.S.," he explains. "Brands that source the technology and materials for LED products outside of the US will have increases in their production costs as well."

While it isn't clear where all red light therapy treatments originate from, Shark manufactures their products in China, per the brand's site, but they have plans to shift more production to Vietnam, Cambodia and Indonesia.

Dyson has continuously been a Shop TODAY Beauty Award winner and favorite, including their Corrale Styler Straightener, which won an award last year. The brand hasn't disclosed their plans for tariffs yet, but all of their products are made or designed in Malaysia, the Philippines, Singapore and the United Kingdom, based on their website. Malaysia is their second biggest hub, which Reuters reports has a 24% tariff.

How are beauty brands responding to tariffs?

“For brands, tariffs present both a challenge and an opportunity,” says Olu. “On one hand, rising costs and uncertain trade policies can pressure margins and complicate production timelines. On the other hand, they can encourage innovation by prompting companies to diversify suppliers, invest in local manufacturing or reformulate with alternative ingredients that are more accessible or sustainable.” This will make transparency extra important, which brands are aiming for.

- David Thurston, salon owner and Founder and CEO of Danger Jones: “We’re holding off on making any permanent changes until there’s more clarity on long-term policy,” he says. “We work with labs around the world. If the tariffs become permanent, we’re prepared to explore U.S.-based labs and component manufacturers to ensure we keep prices low and products in stock for professionals, without compromising the high-quality ingredients our customers expect.” Thurston adds that they will prioritize their clientele first noting that they have even decreased prices on various products since January and will continue to keep their formulations the same.

- Michelle Ranavat, founder of Ranavat: “We want our product to continue to be made in India,” the founder emphasizes. “We’re going to try to do anything and everything we can to not raise prices on the consumer and continue telling that story... I do want to reassure people that we won’t be changing our formulas, and we won’t be changing, in the near term, our prices. We want to just stay as true to the mission.”

- Sabeen Mian, President of Performance Beauty Group’s Lash Division (Lilly Lashes, Velour Beauty, Flutter Habit): “I do not want to go out of stock; I want to be able to service my customer,” Mian says. “I don’t want to raise prices right away or pass on the cost of the tariff to the customer ... I think across all three of our brands, craftsmanship [and] consistency are a really big piece of why our lashes are beloved by our customers. So it’s something that we’re really focused as we’re going through this process of negotiating with our suppliers [so that] we’re not compromising at all on quality.”

- Jenny Frankel and Taylor Frankel, Nudestix Co-Founders: “We believe our consumers in our community already have a lot of macroeconomic concerns and are making every effort not to pass on any additional costs ... We want to assure our customers and community that we are making every effort to reorganize internally, negotiate with our suppliers and identify new sources of supply to bypass tariff impact and minimize impact on the end consumer.”

How to adjust your shopping habits to prep for tariffs

According to a 2023 survey, the average person uses around 12 beauty products daily. While including multiple serums and creams is important to our routines (we’re guilty of it, too!), the rise in tariffs means we might need to simplify our beauty products, or simply keep track of their prices.

“Simplifying our beauty routines can be a way to offset tariff-related price hikes. However, doing so can result in using larger quantities of the products you continue to use, i.e., if you use three different serums and elect to use only one moving forward, you will use that one serum faster,” explains Bodge. “That said, be mindful of the prices of the items you keep in your rotation.”

If you don’t want to let go of a product or two, Bodge recommends looking for budget-friendly alternatives, switching from luxury brands to more affordable options and paying more attention to sale events, such as Amazon Prime Day, and loyalty programs to earn exclusive deals and points.

Frequently Asked Questions

As previously reported, Bodge predicts that U.S.-based brands will keep their prices the same to remain competitive against foreign brands. However, "These decisions will likely be based on where ingredients come from," she adds. "If from the U.S., prices should remain stable; however, if any ingredients are imported, prices to the consumer are likely to increase to account for higher import prices."

According to Hu, "Under the 'Buy American Act' for government procurement, a product must be manufactured in the U.S. with more than 50% U.S.-made parts to qualify," hence why some brands manufacture elsewhere.

Because the cost of imported goods will increase, we expect beauty retailers like Sephora and Ulta to make price adjustments, too. Smaller beauty retailers might be hit the most due to the risks of profit. According to Forbes, about 90% of these businesses' supply comes from China.

How we chose

We spoke with beauty and financial experts, along with beauty brands themselves, to get their expertise on what to expect from tariffs and what to shop now. While not all brands listed above have mentioned price increases, we based our picks on research and our experts' feedback.

Meet the experts

- Jason Miller, PhD, is a professor and interim chairperson of the department of supply chain management at the Broad College of Business at Michigan State University.

- Trae Bodge is a smart shopping expert and founder of True Trae.

- Esther Olu is a cosmetic chemist, licensed esthetician and instructor.

- Dr. Shuting Hu is a cosmetic chemist and founder of Acaderma.

- Dr. Howard Sobel is a board-certified cosmetic dermatologic surgeon at Lenox Hill Hospital.

- David Thurston is a salon owner and the founder and CEO of professional hair-color brand Danger Jones and Butterfly Loft Salon and Spa.

- Michelle Ranavat is a holistic beauty expert and the founder of skin care brand Ranavat.

- Sabeen Mian is the President of Performance Beauty Group’s Lash Division.

- Jenny Frankel and Taylor Frankel are the co-founders of makeup brand Nudestix.