TODAY

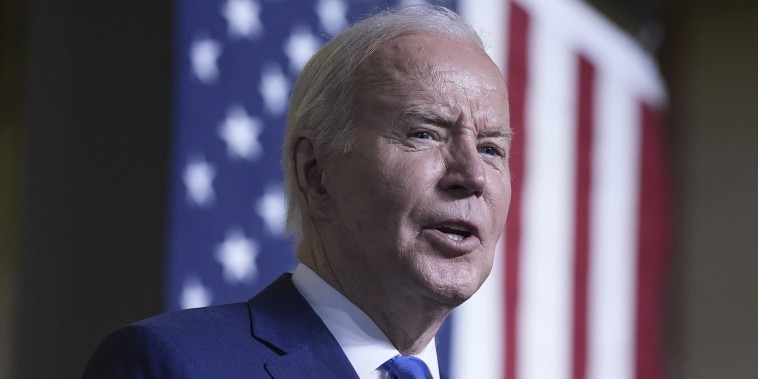

Biden says US won't send weapons if Israel invades Rafah

President Biden says the U.S. will withhold more military aid if the Israeli military carries out an all-out assault on Rafah and has noted that American-supplied bombs have already been used to kill civilians during the seven-month war. NBC’s Gabe Gutierrez reports for TODAY.