As Hurricane Irene races toward the Eastern United States, Americans should be bracing for high winds, pounding rain - and a costly clean-up bill.

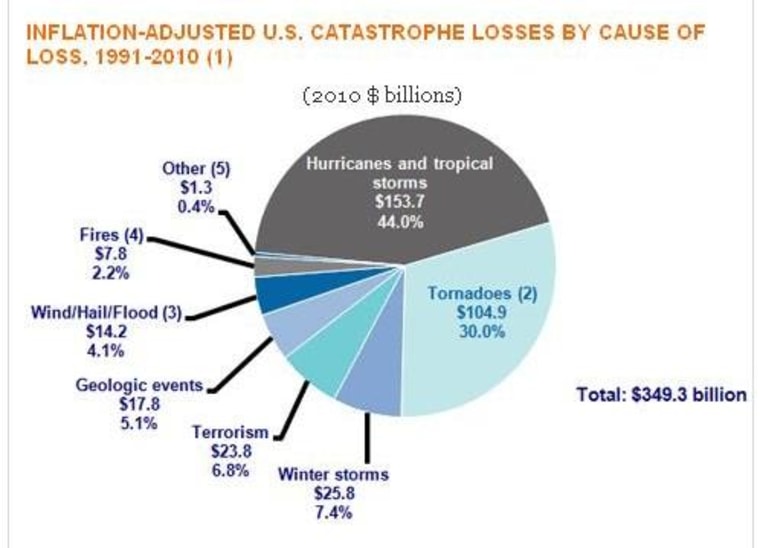

Hurricanes and tropical storms have accounted for $153.7 billion in insured losses over the past nearly two decades, according to the Insurance Information Institute, a lobbying group. That adds up to nearly half of all private-sector claims payouts for natural U.S. catastrophes.

The insurance group tallied the total cost of all natural disaster insurance claims payouts in the United States between 1991 and 2001. The inflation-adjudsted $349.3 billion bill, calculated in 2010 dollars, included payouts from auto, homeowners and business insurance policies.

Tornadoes were the second costliest class of disaster, accounting for 30 percent of all payouts.

The III says hurricanes are especially costly because they can cover such a wide area. A hurricane that hits full force in Texas or Louisiana, for example, can still cause millions of dollars in damage as a bad rainstorm hundreds of miles away.

Terrorism also accounted for 6.8 percent of all payouts, mainly because of the Sept. 11 terrorist attacks.

The figures exclude flood claims.