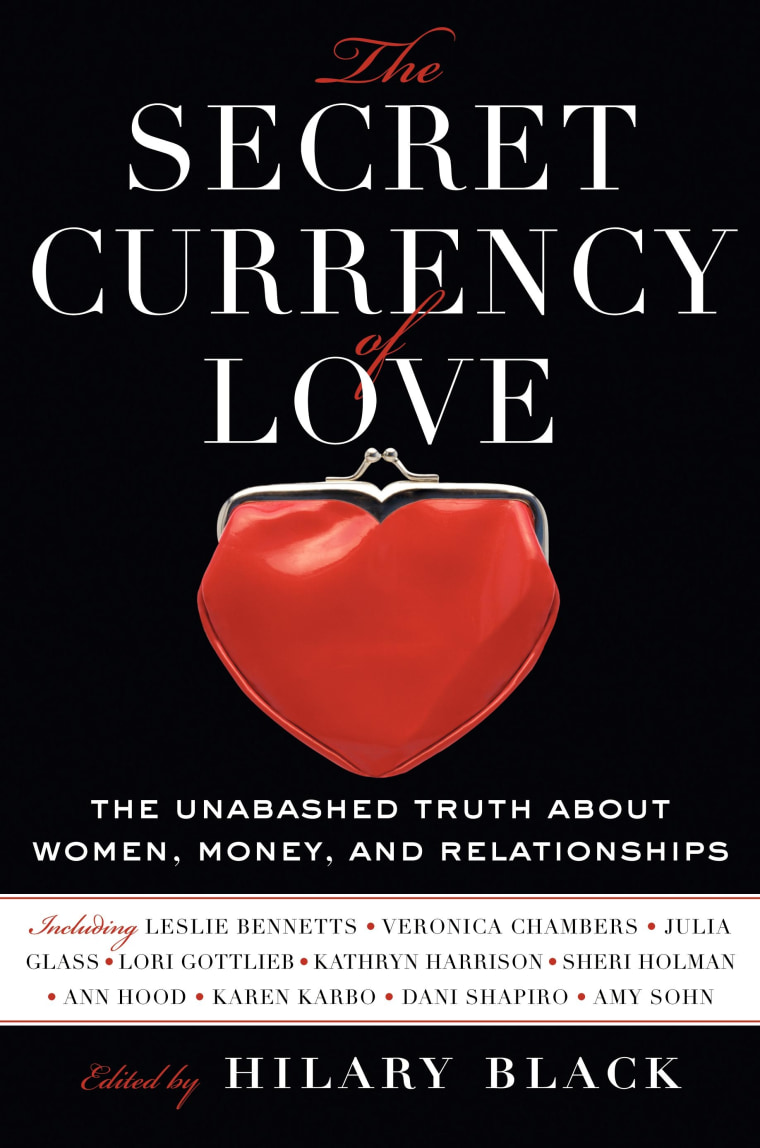

When it comes to discussing intimate affairs in our society, money might be an even more taboo subject than sex. But in this current economic climate, personal finance issues have come to the forefront of conversation. Hilary Black, editor of the anthology “The Secret Currency of Love” — a collection of essays about love and money — discusses the role that money plays in our interpersonal relationships.

Q: What made you decide to put together an anthology about love and money?

A: Well, for one thing, I was interested in the personal side of money, which was not covered very often by the mainstream press. But my “aha” moment came after a breakup with a wealthy boyfriend who, in the end, I didn’t particularly connect with. A few of my educated, otherwise liberal friends questioned my decision to end the relationship because, as one put it, “this guy could take care of you for life.” I was surprised by that reaction; it made me want to explore the subtle, often thorny ways that money affects personal relationships.

Q: Why is money — something so essential — often such a taboo subject in interpersonal relationships? Is talking about money still more taboo than, say, sex?

A: I think the forbidden nature of financial topics is a vestige of an earlier age, when certain subjects were off-limits. Back then, you could complain all you wanted about your husband’s personal shortcomings — but discussing his income was a kind of betrayal. Today, I think money remains a charged topic because, for many people, it’s a proxy for self-worth and self-esteem.

Q: Do you think the current dismal economy will help bring money talks to the forefront of relationships? Or will the taboo persist, causing more rifts as the economy goes from bad to worse?

A: In an economy like this one, money conversations in intimate relationships will be all but unavoidable. People’s lives and careers and standards of living are changing dramatically, and it’s hard to imagine that it won’t spill over into the personal arena. This isn’t necessarily a bad thing, to my mind, since shelving money discussions is often unhealthy in the end.

Q: Will this economic crisis cause people to be more open about money in general, in the workplace and in social circles? Would that be a good or dangerous thing?

A: I think it will — and as far as I’m concerned, more openness about money and the power it wields in our personal lives is about the only upside to this dismal economy. Because this is happening to all of us, it will be cathartic to be able to acknowledge our financial worries — something that as recently as six months ago was not appropriate for dinner party conversation.

Q: The essayists in your book — and many other people — equate money to things like freedom, power and security. Do we allow money to control too much of our lives?

A: No one can deny the immensely powerful role that money plays in shaping our life decisions. For example, one woman in the book chooses not to have a second child, because she realizes she can't afford it.

But there's such a thing as assigning too much power to money — as with the unchecked greed that led to the current financial meltdown. So in the end, it's all about striking a balance.

Q: Do you think men and women approach money differently when it comes to talking about it, making it, needing it?

A: Absolutely. Women are generally more comfortable than men at verbalizing their problems. But because many women have been sent mixed messages about their own earning options, they often possess complicated, ambivalent feelings about money that are difficult to express. Both women AND men are coming to terms with the Cinderella myth. So in the end, perhaps the best shot at bridging the financial gender gap is honesty.

Q: In your research for this book, what was the most shocking story you heard? And what was the most surprising lesson you learned?

A: There were a number of them. But one that stands out is the story of a woman who fell in love with a homeless drug addict and stayed with him for three years, to the shock of her friends and family. The lesson I learned is the universal role that money plays in personal relationships. Rich or poor, single or married — everybody has financial issues to work through.

Q: What do you want readers to take away from this collection of essays?

A: First and foremost, I want people to enjoy these stories. They're personal, they're beautifully written, and they're deeply revealing. I also hope that, as I did, readers will see bits of themselves in every essay — and if they can use that information to clarify and navigate their own financial challenges, all the better.

Click here for a trailer for the “The Secret Currency of Love,” and find out more about the book here.

Hilary Black has spent her career as an editor in both books and magazines, with positions at Random House, HarperCollins, Simon & Schuster, More magazine (where she was a founding editor) and Tango Magazine (where she was editor-in-chief). She lives in New York City.