Americans may make plenty of jokes about cheating on their taxes, but a new survey finds that in reality most don’t think it’s OK to rob the tax man. Or at least, that’s what they’re telling the IRS Oversight Board.

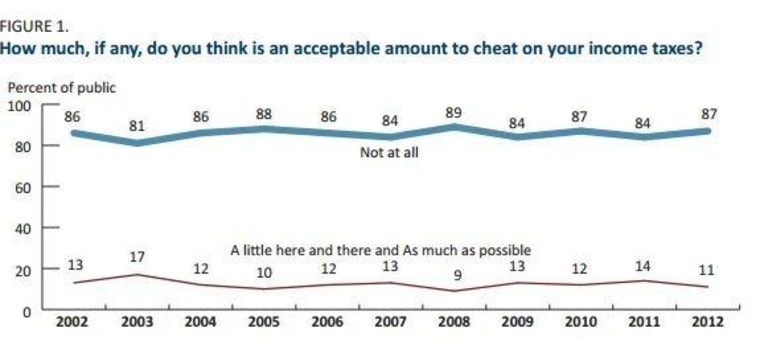

The 2012 Taxpayer Attitude Survey, released Tuesday by the independent oversight board, finds that 87 percent of Americans don’t think it’s OK to cheat on your taxes. That’s a 3 percentage point increase from last year.

Only 11 percent think it’s OK to cheat, either a little or as much as possible.

Perhaps more surprising, 95 percent of Americans said their personal integrity influences them to report their taxes honestly, an 8 percentage point increase from five years earlier.

About 63 percent said they are influenced by fear of an audit, while 70 percent are motivated by third-party information that could show them to be a tax cheat.

The IRS Oversight Board, an independent body created by Congress in 1998 to oversee the Internal Revenue Service’s actions, completed its annual survey of 1,500 Americans last August and September. The survey has a 3.1 percent margin of error.

If they’re going to pay their taxes honestly, most Americans seem to think everyone else should, too.

The survey found that more than 90 percent of Americans think it’s important that the IRS ensures that low- and high-income taxpayers, small businesses and corporations honestly pay their taxes, too.

Those results appear to show that Americans have come to feel more strongly in recent years that everyone should pay their fair share of taxes, and the IRS should vigorously enforce tax laws.

The results come as many Americans are either getting ready to file their 2012 income tax returns, or already have done so.

They also follow a bruising battle in Washington over the so-called fiscal cliff, a series of tax hikes and spending cuts that were scheduled to take effect until Congress reached a last-minute deal.

The fiscal cliff agreement raised taxes for wealthy Americans earning $400,000 or more and allowed taxes on capital gains and dividends to go up. It also ended a payroll tax holiday, meaning that most Americans are seeing more of their paycheck going to the tax man for Social Security and other entitlements this year.

Related: