When Ahmad Ismail, an alumnus of St. Benedict’s Preparatory School in Newark, New Jersey, began his career on Wall Street, he’d never played golf before. Growing up in a low-income minority neighborhood, he didn’t have access to a sport so commonly associated with country clubs and wealth.

But as a Black man working with other financial professionals, Ismail learned that golf was a popular bonding activity.

“I think that most of the students at St. Benedict’s try to transition into the Wall Street, front office world, where you’re in meetings with executives or senior officials at your institution and trying to relate to a lot of the social elements that come with the job,” he told TODAY over Zoom. “(Golf) is just one element of the conversation and relatability that may be challenging for somebody coming from our kind of background.”

Now, the 30-year-old is hoping to demystify the finance world for the young men at his alma mater.

According to its website, St. Benedict's is dedicated to serving socioeconomically disadvantaged students. Seventy-eight percent of its population is Black and Latino — a stark contrast to Ismail’s post-undergraduate job at JPMorgan Chase, where Black and Latino people make up 33% of the total workforce and a mere 9% of executives as of December 2019.

Through St. Benedict's new Gray Bee Investment Club, students in the all-boys high school division have the opportunity to enhance their financial literacy skills and learn how to navigate careers in finance.

“The larger goal is to have kids come out of this with the confidence that finance is a world they belong in, and the belief that they can build capital and wealth for family and the future,” said Mike Scanlan, dean of administration at St. Benedict's, who started the club after the school shifted to remote learning during the coronavirus crisis. Students had always expressed an interest in investing but never had the time to commit to a real club until the pandemic.

Co-chairs Amari Thompson and Justin Crespo, both 16 and part of the class of ‘22, said that their knowledge of finance was at a “bare minimum” when they joined the club.

“My take on the stock market and investing was kind of, ‘Do this if you want to get rich. Do this if you want to make a lot of money in a quick amount of time,’” said Thompson.

He soon discovered that this isn't the case — because while the Gray Bee Investment Club has only ever met virtually, its 25 or so members have covered a lot of ground. They’ve studied basic terminology, hammering out the mechanics of the stock market and bonds and mutual funds; they’ve played a stock market game, creating investment portfolios with an imaginary $25,000 and tracking their performances in the long term.

Over the past few months, club members have become so well-versed in investing that Crespo and his group’s portfolio grew more than Scanlan’s.

“It’s interesting when you get outdone by your students,” he said. “It's an interesting time to be doing this, too, because everything in the news is really alive in the markets."

Gray Bee particularly prides itself on connecting its members to alumni with careers in finance. From the head of Goldman Sachs’ municipal trading desk to Ismail, now an MBA candidate at Columbia Business School, the robust mentorship is intended to prove to the students that men of color — men who look like them — can make it.

Ismail said there's always someone to “call on and say, ‘Hey, I’m experiencing this challenge, has this ever happened to you?”

That challenge might be an unfamiliarity with golf, or something with a little more weight — like how, during his time at JPMorgan, Ismail found himself on a project that included the financing of private prisons (which the company has since cut ties with).

“I’m sure we don’t have to go into what prisons’ roles are for people of color,” he said.

Having more diverse opinions within the room generates more stimulating conversations.

Ahmad Ismail

In that instance, Ismail voiced his concerns to the manager and was taken off the project; still, he explained that in general, finance can “put you in a lot of different avenues where you may not necessarily agree with the actions of your customer or your client.” He acknowledged that Wall Street is “not necessarily the sexiest occupation,” especially in the current political environment.

At the same time, he believes it’s possible that the harmful actions of investment banks are, in part, a byproduct of their homogeneity.

“Having more diverse opinions within the room generates more stimulating conversations,” said Ismail. “So increasing the diversity of background will all be accretive, I think, to the success of a company (in that regard). For the individuals that we're talking about specifically, having mentorship within the field is paramount.

This sentiment indicates a larger belief about the Gray Bee Investment Club — that it’s not just about helping men of color realize a place for themselves in the finance world, or even equipping them with lifelong financial literacy skills. Rather, through those avenues, the club claims to address broader issues of “racial inequality and the Black-white wealth gap.”

As Scanlan puts it, the club is a “positive example of a school making concrete change.”

However, William Darity Jr., a professor of African American studies and economics at Duke University, is skeptical about financial literacy- and career-based approaches to inequality.

In fact, those very approaches are cited as common myths in his 2018 report called “What We Get Wrong About Closing the Racial Wealth Gap.”

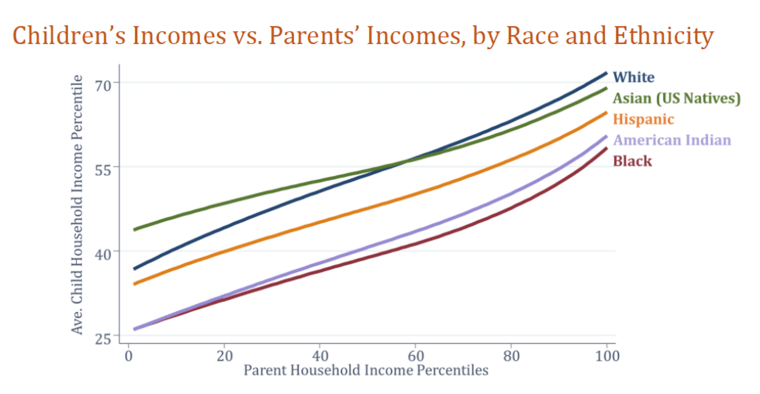

Descendants of enslaved Black persons constitute 13% of the nation’s population but only possess around 2.5% of the nation’s wealth, Darity told to TODAY over Zoom. The disparity is primarily caused by “intergenerational transmission effects” — or how previous generations of Black Americans have been robbed of the opportunity to both accumulate wealth and transmit it to younger generations.

“That's very different from some notion that wealth accumulation is primarily a consequence of your individual income and savings activity,” said Darity. “You don't remedy that by simply trying to improve people's opportunities for becoming investment bankers.”

If people are genuinely concerned about the racial wealth gap — and not mere “individual aggrandizement" — he argues that a reparations program would have the most meaningful impact.

“I’m not saying people shouldn’t engage in (finance and investment) clubs,” Darity said. “I think people need to be honest about what that can and cannot do. And I think it’s really important for people not to overstate what the possibilities are for those types of activities.”

In other words, Darity’s research doesn’t mean that encouraging financial literacy is a bad thing: Rather, it can be thought of as good in a vacuum without necessarily being mistaken as a vehicle for social change.

Even if Gray Bee really is only a financial literacy club, those involved describe it as an exceptional one.

Ismail pointed out that some of his friends — at least a decade past high school — still struggle with concepts that the students at St. Benedict’s are mastering. Plus, when it comes to fostering alumni-student relations, Gray Bee is the best model he's seen.

“I have alumni numbers in my phone from 2004, when I was born… And then there’s younger guys that have my number; they can call me when they need me,” said Thompson, the Gray Bee co-chair. “So I just think that the club really builds on our foundation at the school. And we’ll continue it for a long time.”