The next time a friend of yours e-mails you to ask to borrow some money, take a closer look at that e-mail address.

It turns out, the e-mail service your friend uses may tell you a lot about whether you’re likely to get paid back.

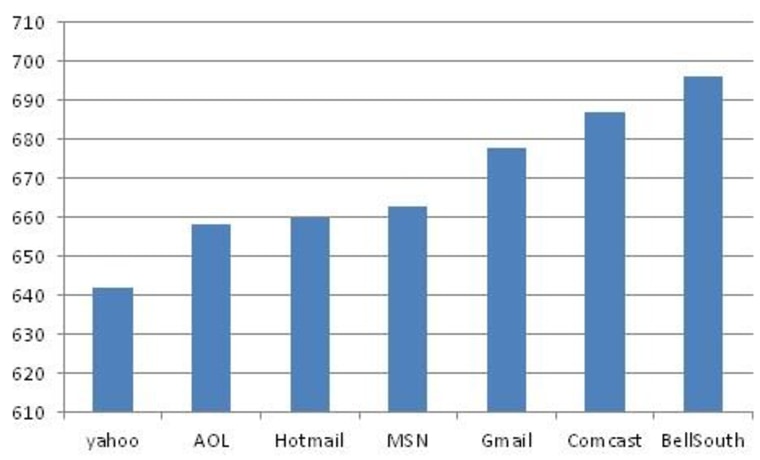

The website Credit Karma recently took a look at its database of around 100,000 users to figure out the average credit score of people who use various e-mail services. Credit Karma provides people with free credit scores subsidized by advertising, and offers people deals based on their credit scores.

Based on Credit Karma’s number crunching, your buddy with the Gmail address could be a better bet to lend that money to than your pal who uses Yahoo.

A credit score can range from 501 to 900. A higher score is considered better, as the person is expected to be most likely to pay off their debts on time.

The results were surprisingly similar to what Credit Karma found about three years ago when it ran the same experiment with just 20,000 users. The company provided more recent data at Life Inc.'s request.

Does it surprise you that there seems to be a link?