Budgets can seem intimidating and difficult. Perhaps that's why 28% of U.S. adults having no emergency savings at all, according to a recent survey by Bankrate.com.

"Budgeting is essential," Rachel Cruze, daughter of personal finance guru Dave Ramsey and a personal finance expert herself, told TODAY. "Be intentional with every single dollar you make. If you're on a budget and you stick to it, you'll never have the realization or fear of wondering where your money went."

With so many budgeting methods, systems and tricks to try, we asked five TODAY interns — students learning the art of maximizing each paycheck — to try different methods and keep track of their experiences. While Cruze recommends taking about three months to get a budget to stick, our team spent three weeks to determine if the process worked for them.

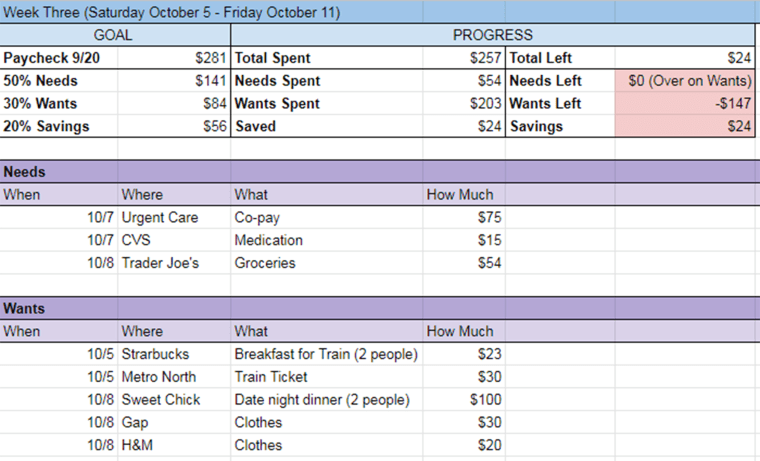

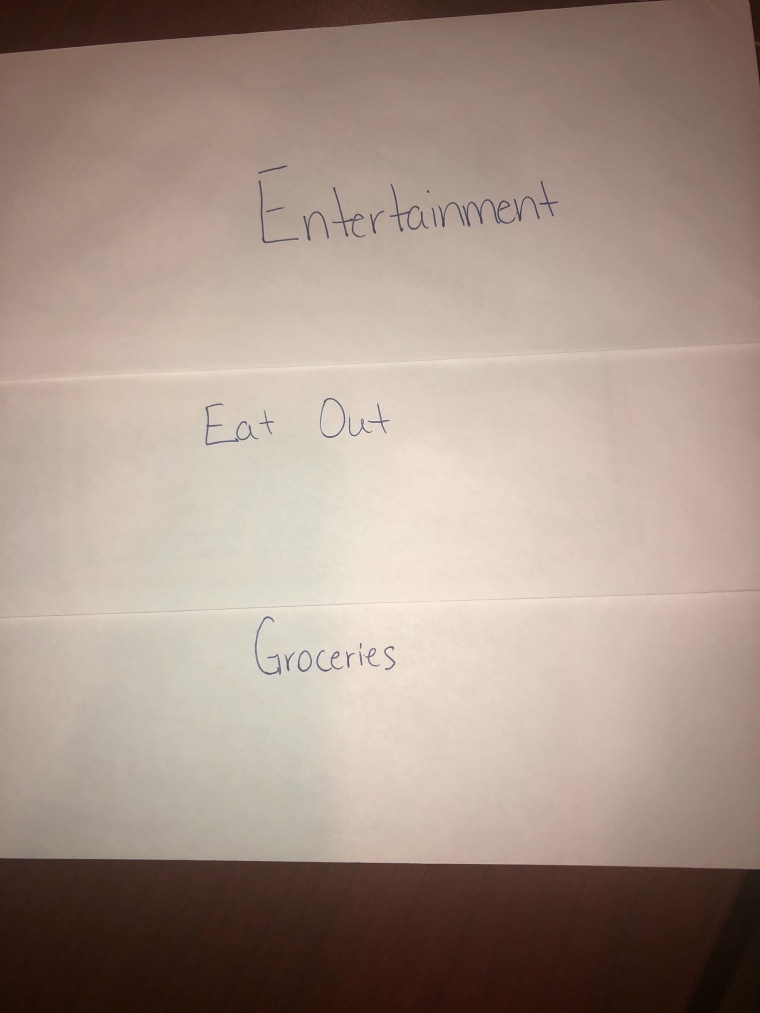

50-20-30 Rule

Editorial intern Allison Ingrum tried the 50-20-30 system.

How it works: Spend no more than 50% of your post-tax income on needs (rent, utilities, groceries), save 20% and only use the remaining 30% for wants (travels, shopping, extra food).

The experience: As a first-time budgeter, I appreciated the 50-20-30 rule for telling me exactly what to do. With this method, I found it easy to justify using some "needs" budget on "wants" purchases. I figured that if I didn't spend more than the combined 80% on those categories, it was OK, right?

Wrong.

The method warns against this. If I only allocate 30% of my paycheck to wants, there is no possibility of overspending, ensuring I always have enough to cover my needs. In the case I didn't need or spend it all, the more I saved. Though this is a basic concept — the less you spend the more you save — it was much clearer to see when the dollar amount fluctuated in front of my eyes.

Having to admit my purchases to myself proved to be the most difficult task. There was no “forgetting” purchases when I had to write each down. For example, I soon realized small food purchases are my weakness. By the third week, I began to bring homemade coffee to work rather than my typical Starbucks run.

Forcing myself to budget had an unexpected benefit. By needing to consult my bank’s app more frequently, I noticed four fraudulent Chipotle charges the day after they were made. Normally, it would have taken me a week to notice, which means I got the money back before it became a larger issue.

This method’s primary downside is having no formal way to track spending. While this leaves room for personal preference and creativity, it is important to choose a method wisely. While tracking the budget on paper is a viable option, I chose to make mine digital on a Google Doc. I set it up so that when I added my spending, it automatically calculated how much money I had left in the respective categories.

Most importantly, it is essential to be organized with this method. No matter how you choose to track your budget, setting up a routine to input your purchases — whether it's after each transaction or every night before bed — to calculate how much is left in each category is the key to making this method successful. Adding up expenses and hoping for the best at the end of the week won’t help. Trust me, I tried that on week two and I went over budget.

The verdict: I will definitely continue to budget using the 50-20-30 method since it is such a simple, straightforward guide. At this point in my life, it forces me to be conscious of my spending and yet is forgiving enough when I'm not always perfect.

Envelope Method

Commerce intern Kamari Stewart tried Dave Ramsey's envelope system.

How it works: To use this method, think of categories that require a cash envelope and then budget for those areas. If you run out of cash in one envelope, you can’t dip into another one. Instead, you might have to get creative.

The experience: For the past three weeks, I’ve been living out of cash-filled envelopes (for example, I have one specifically designated for eating out with a budget of $30 per week).

When I first sat down and crunched the numbers for my expenses, I was a little worried. Last-minute things come up that are hard to plan for, but I did my best to anticipate anything. It wasn’t long before I was stuffing six categorized envelopes with cash and making note of the budgets for digital expenses (commuter pass, savings, credit cards). Then it was time to get into it.

There’s the plan, there’s the budget and then there’s reality. When I first heard about this envelope system, I planned to put so much money in each envelope to keep me comfortable. I soon realized while budgeting that that wasn't feasible, so I made a more realistic plan. Reality ended up being somewhere in between the two.

The first day was already much harder than I thought it would be. I usually buy coffee in the mornings, but I realized that would quickly use up all the money in the “eating out” envelope. I also tend to buy my lunch because it spares me the at-home prep the night before. Instead, I opted to drink free coffee in the office and meal-prepped for the entire week on Sunday night. Having the same meal every day got a little boring but it did make me want to experiment more with cooking.

"There’s the plan, there’s the budget and then there’s reality."

By the end of week two, I had gotten into the habit of bringing my lunch and making different dishes that I could enjoy for more than one day. Coffee became a Friday treat and I took advantage of as much free food as possible.

I somehow managed to stay on budget each week. Allocating money to buy something I wanted helped me reach my goal by allowing me to satisfy a desire without going overboard. Plus, it was something to look forward to each week, even if it was something small, like a new body butter from The Body Shop.

The verdict: Overall, I can’t deny there’s been a change in my spending habits. I’ve been hyperaware of exactly where my money is going since I have physical proof of its absence. However, I’m not sure this is the best plan for long-term budgeting. I can’t imagine living out of envelopes for longer than these three weeks. But if you’re looking to save money a few weeks before a vacation, this system might work for you.

Dollarbird

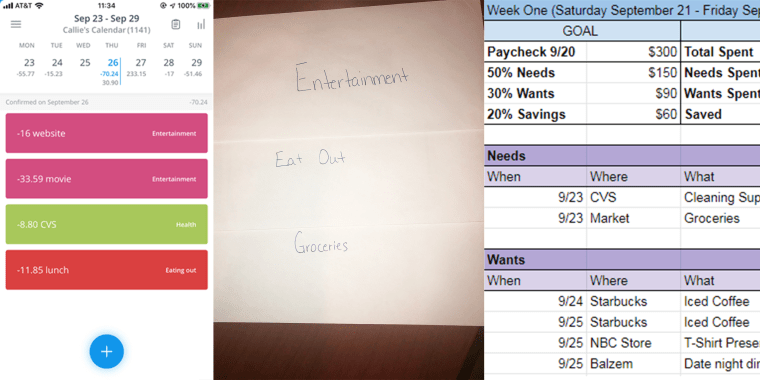

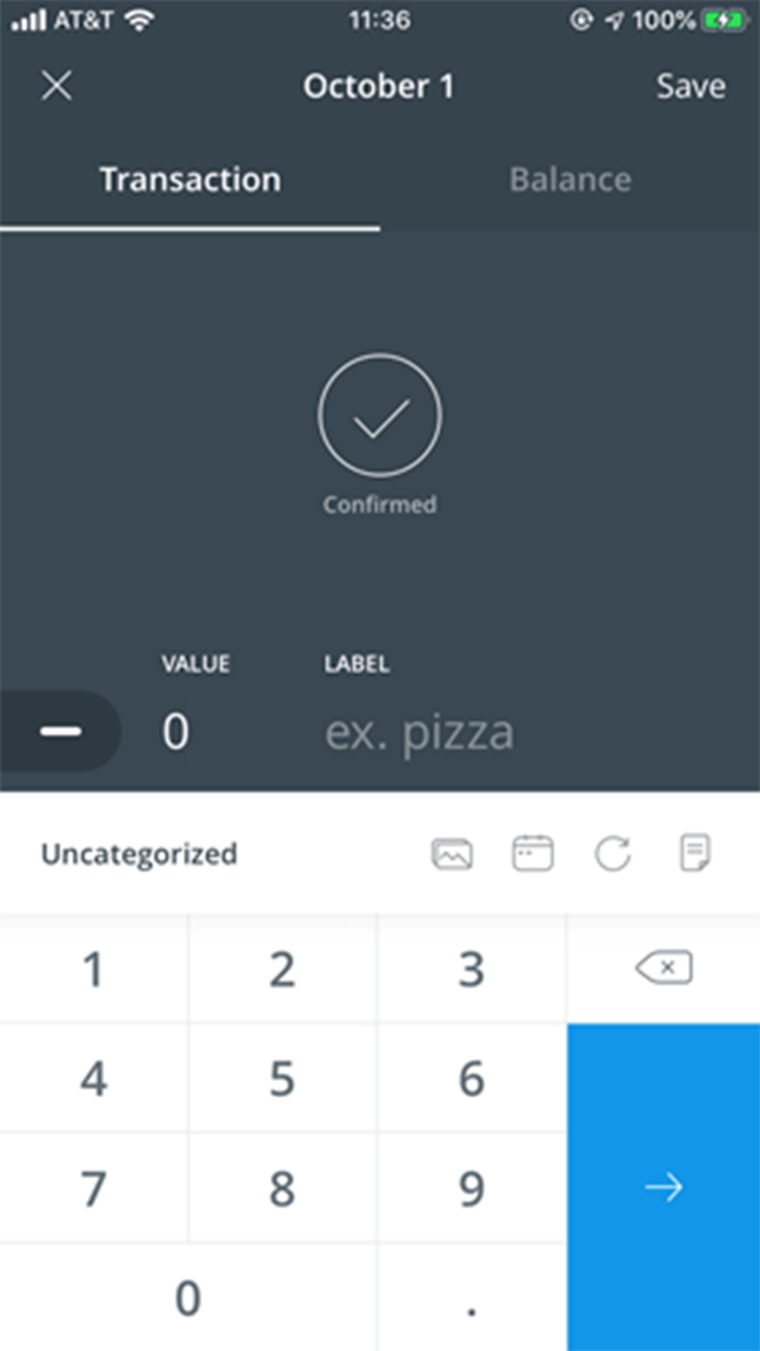

Editorial intern Callie Patteson tried the Dollarbird app.

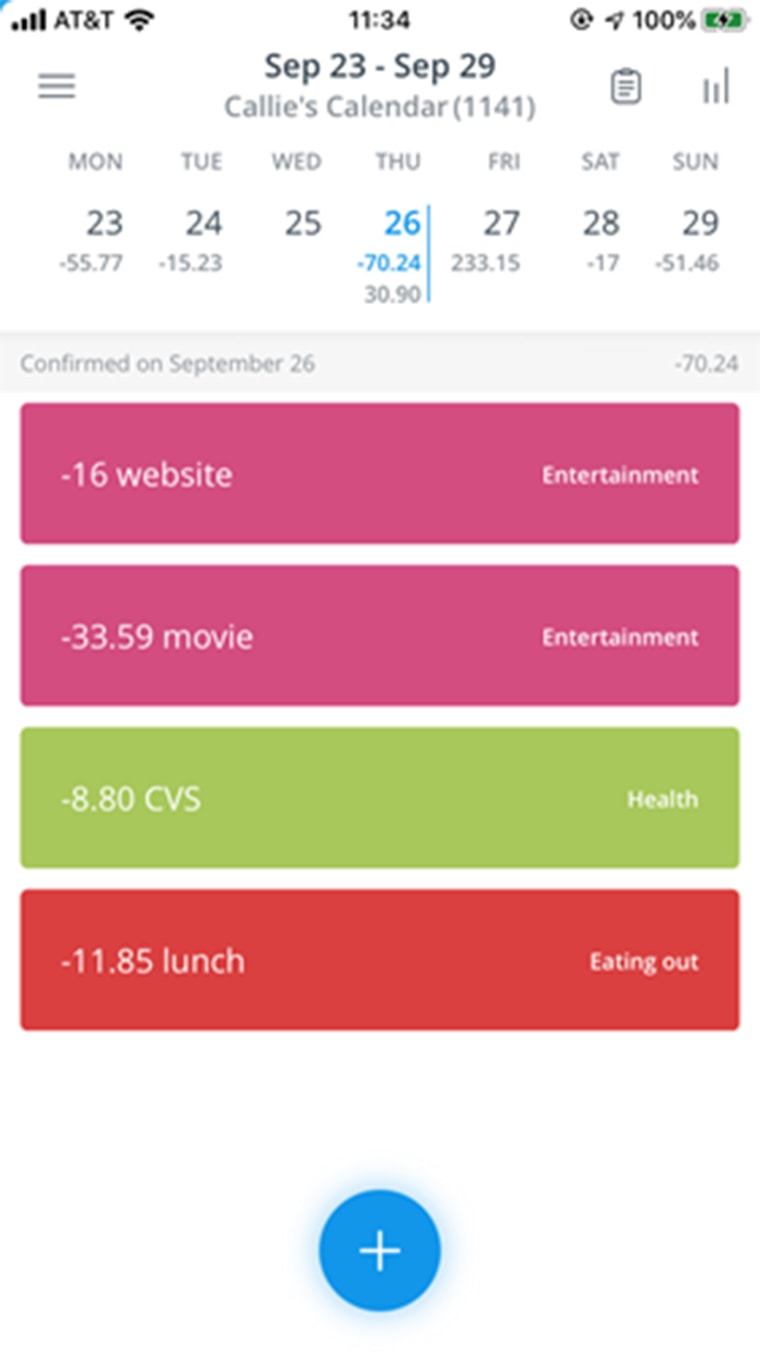

How it works: Dollarbird is a free personal finance calendar app that allows users to input transactions according to the day they were made. Over time, Dollarbird will categorize spending and show users which category they spend the most in and whether it varies from the month before.

The experience: When using the app, you have two main options when it came to entering transactions: adding or subtracting. As shown in the image above, there is the minus sign next to the box for the value. At first, I thought I had to enter income in the balance. However, when you do that, it completely changes the balance to that value instead of adding it to the original one. It was unclear that I had to select the minus sign to change it to a plus sign to add a positive transaction.

After entering the value and labeling the transaction, Dollarbird automatically categorizes charges as entertainment, eating out, transportation and more. There is a hiccup: Many times, Dollarbird gets the category wrong. For example, whenever I enter CVS, the pharmacy, it categorized it as a subscription. Dollarbird gives the option to rename the category, which I did, and gives the option to turn off the automatic categorization.

My biggest problem with the app is manual entries. Unless you turn on reminders to input charges, nothing will prompt you to go into the app. While the app subtracts and adds all the charges, there is no real difference between it and an Excel spreadsheet, other than it looking like a calendar.

The verdict: Dollarbird is free, but in my opinion, it’s not worth the time. I found myself having to input charges for that day and up to three days before. It wasn’t helping me save money but acted as another place for me to see the charges — charges I already see in my bank’s app. Over the course of a few months, users are supposed to see a trend of their cash flow across these categories.

I won’t continue using this app for many reasons. I started using it to help me save money, but all it really did was combine my calendar and my bank transactions.

Mint

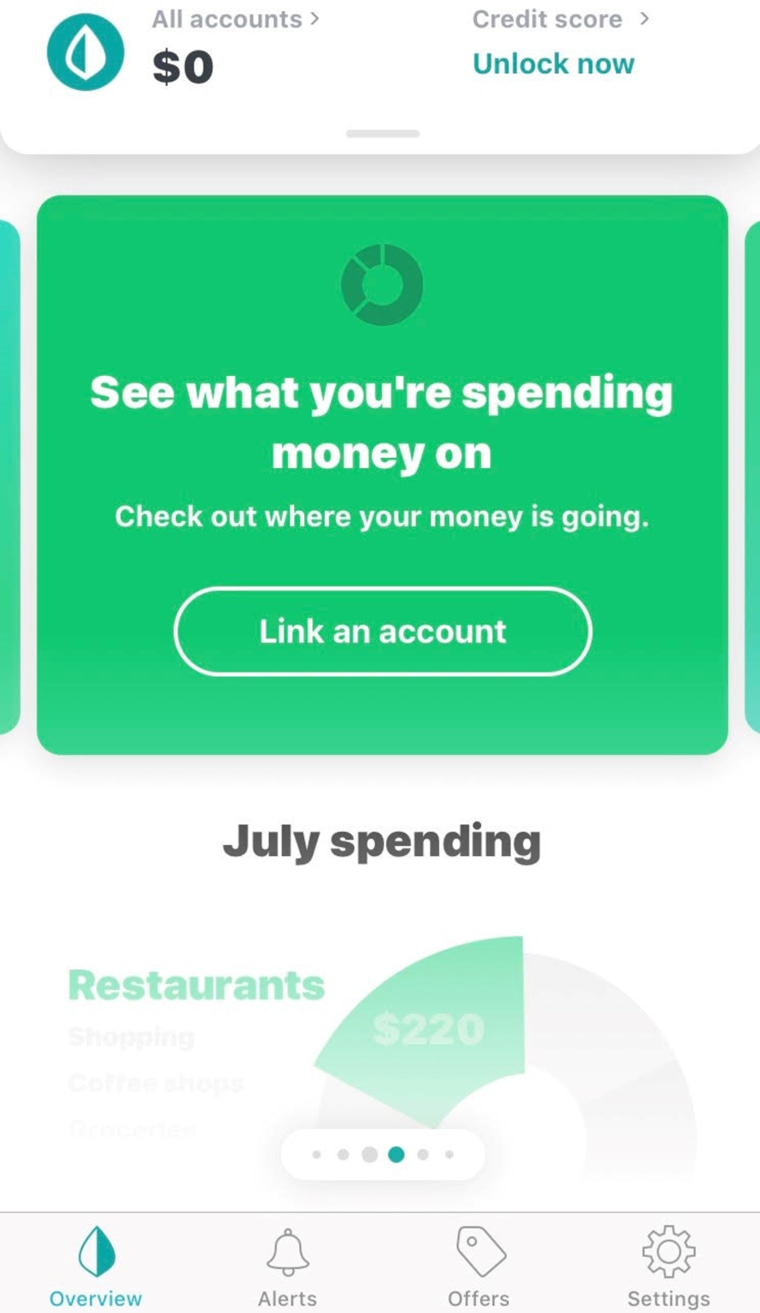

Media intern Amanda Negretti tried the Mint budgeting app.

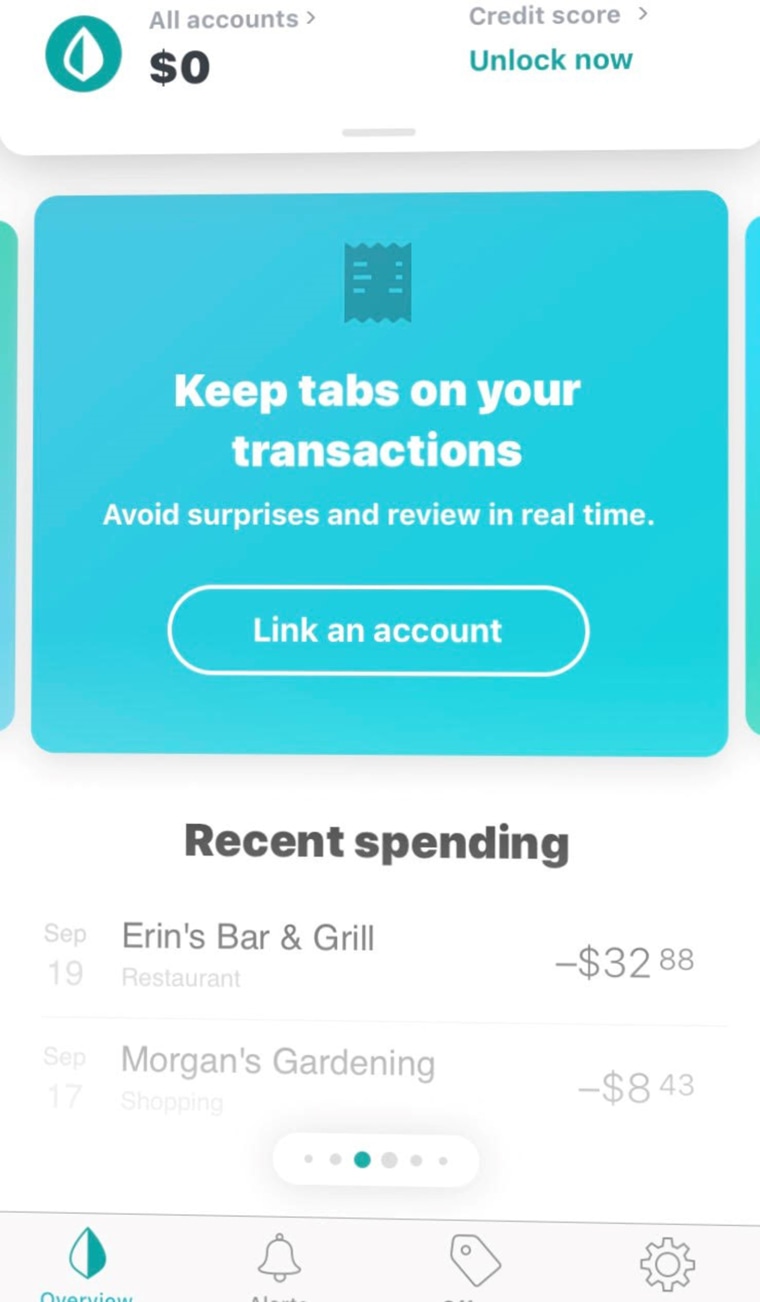

How it works: This personal finance and money app allows users to connect bank accounts and other financial services, like PayPal, in one place. Its primary function is tracking incoming and outgoing money.

The experience: Mint uses a lot of bar and pie graphs, which I find creates a more engaging experience. This also makes the content quicker and easier to understand. The app covers several categories; the main four are spending, budgeting, cash flow and bills.

Using the app was straightforward. Once I started making purchases, it took a few minutes to update, and when I added money to my bank account, the balance didn’t update until the next day. This became inconvenient when I wanted to purchase something and wasn't sure exactly how much I had in the account.

My main expenses revolve around food and transportation. I set a goal for the amount of money I can spend on lunch daily — the budgets tab helped me stay on top of that. It shows how much I’ve spent within the last month and how much money I have left to spend by the end of the month. This budget automatically starts over at the beginning of each month.

When Oct. 1 came around, the charts were empty. When you click them, the charts show spending from last month and this month, so I could really see how much more money I had spent since starting school. Some things, like subway fare, have a fixed price, but seeing the transactions was a reminder of how much money I use for transportation alone. However, this helped me visualize how much money I have left over for other things.

The verdict: I think I will continue to use this app. Although not all the transactions are immediate, it allows me to keep track of what I’m buying before I get the bill in the mail.

Paper budget and writing down purchases

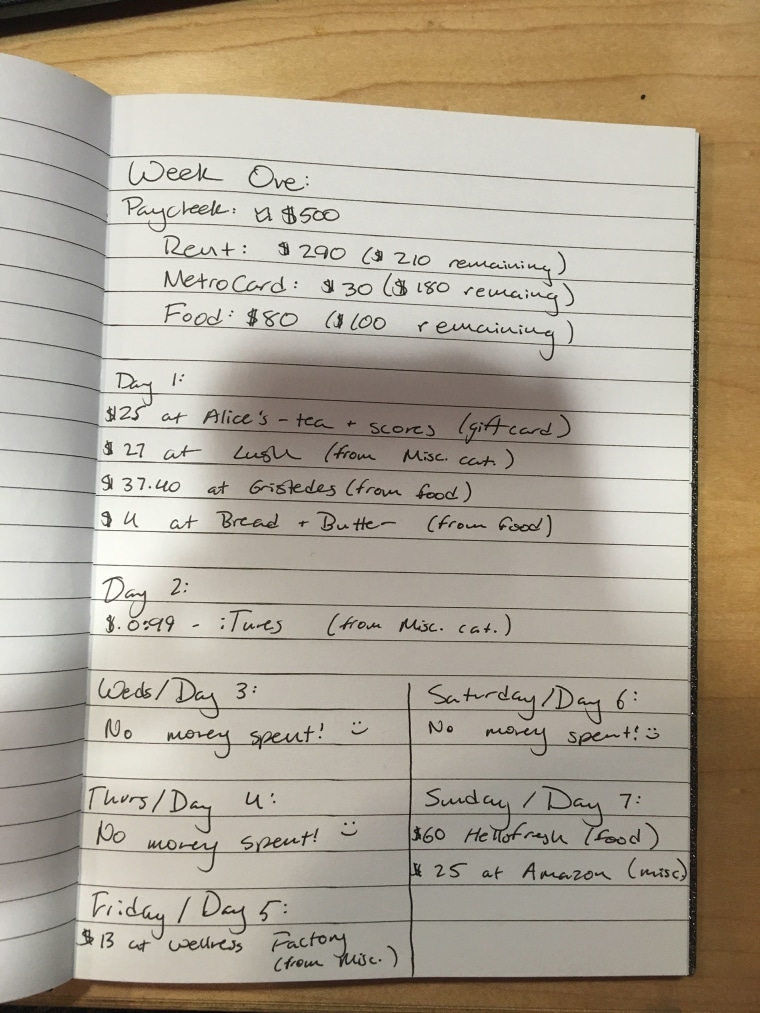

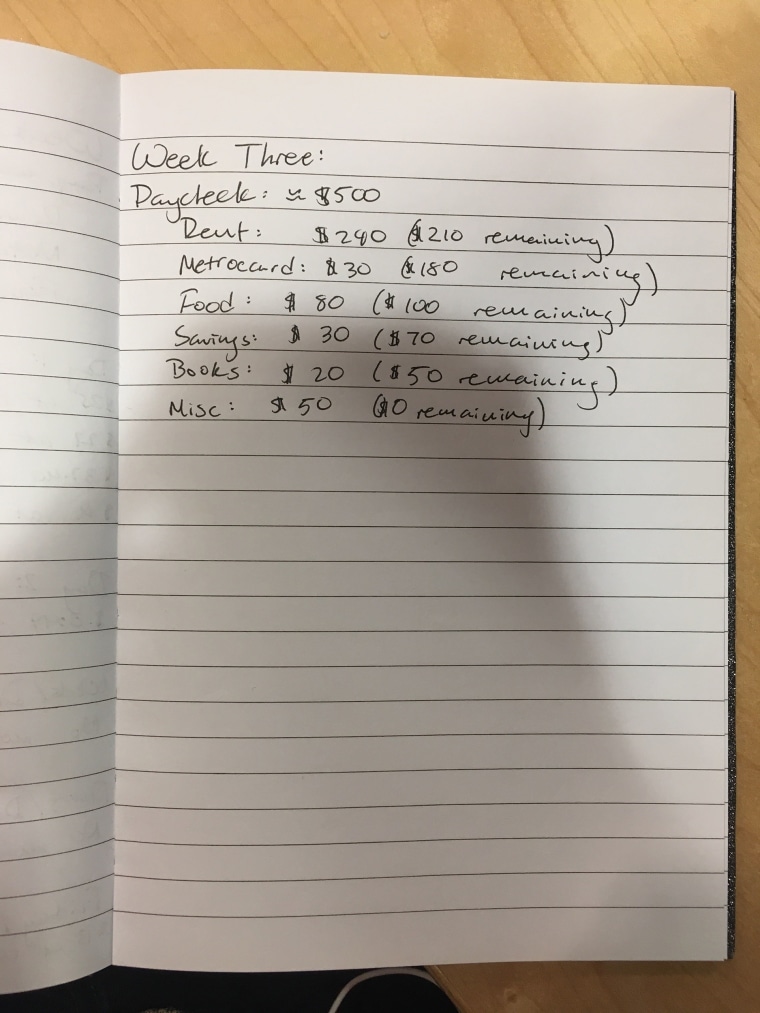

Editorial intern Kerry Breen used a paper budget and wrote down every purchase.

How it works: This combines two budgeting systems: making a paper budget and writing down everything you purchase to be more aware of spending. With my paper budget, I wrote down the week, my paycheck amount and the categories. When it came to writing everything down, I broke it up by day and wrote down what I bought and where.

The experience: As someone who preps meals every week, drinks coffee from home most of the time and doesn't go out a lot, I didn't think I'd have a ton to put in a budget. My utilities are paid with my rent, and I get a monthly subway card, so I didn't think I would have a lot of daily purchases.

When it came to writing the budget, I realized I wasn't sure where to start once I budgeted out things like rent, monthly subway card and food, so for the first week I actually left my budget fairly vague: anything after those three categories could be used for whatever purpose. Once I started writing down my purchases, though, I realized how much money I spent on random things, like snacks at work or smaller Amazon purchases.

For the second and third weeks, I made a more restrictive budget. The rent/food/subway bill took up most of my paycheck, but on average, I had about $100 left afterward. I decided to try to put at least $30 a week into savings. I set a budget of $20 for books (as an avid reader, that was a tight squeeze!) and left the remaining $50 for miscellaneous purchases like store-bought coffee, food and other small purchases.

Once I started doing that, things seemed to move smoother! I felt better about my spending and found myself having money left over at the end of those weeks. I wasn't a fan of writing down purchases, not because of the work, but mostly because it made me realize that I was sometimes spending money on pointless items (like a $6 coffee before class, or $12 worth of snacks). However, since I hated having to come to terms with some questionable purchases, I started spending less and challenging myself to get through days without spending any money at all.

The verdict: I don't think I'll stick with both methods forever since combined, they're a bit time-consuming. But I do think I'll continue to write out a paper budget on a monthly basis. It really helped me keep track of what I was spending and where I could save, which definitely helps make every dollar count.