TODAY

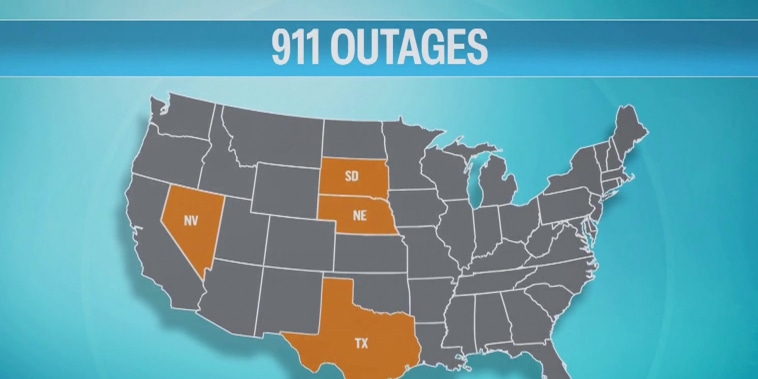

Emergency responders scramble during 911 outages in 4 states

Emergency responders in Nevada, Texas, South Dakota, and Nebraska scrambled during a major 911 outage after phone lines went down for millions of people. While officials do not yet know what caused it, there are concerns that call centers could be the target of cyberattacks. NBC’s Erin McLaughlin reports for TODAY.

-6kn7o3.jpg)