Does $50,000 a year seem like plenty to live on, or not nearly enough?

If you said somewhere in between, that makes sense because $49,445 is the national household median income, meaning about half of all households live on more than that and half on less. The figure, based on 2010 calculations, was reported in September by the Census Bureau as part of an extensive report on income and poverty.

In some places and circumstances, $50,000 is enough for a large family to live comfortably. In others, it’s not even enough for a single person to afford rent, utilities and other expenses.

Four years into the deepest economic downturn in a generation, some Americans, especially those who have experienced bouts with unemployment, are overjoyed to be earning $50,000 a year. Others are devastated to have seen their incomes fall so far.

For some, it’s a mixture of both.

We recently asked the readers of TODAY.com's Life Inc. blog to let us know what it's like to live on about $50,000 a year, and we got hundreds of responses.

“While unemployed I would have been thrilled to make $50,000,” said Dawn Mogan, 55.

Now that she actually makes that salary after two years of unemployment, the single mom in Texas still worries constantly about money.

Many of the readers who wrote to us say that on $50,000 a year they can put food on the table, pay for necessities and even splurge occasionally on a dinner out or a game for the family.

But others told us they have to watch their budgets closely and occasionally make sacrifices to get the bills paid.

“It's not poverty. We don't miss meals and we make MOST of our bills. However, we live paycheck to paycheck, and we carry debt,” wrote Brett Jones, 37, who lives with his partner in Texas.

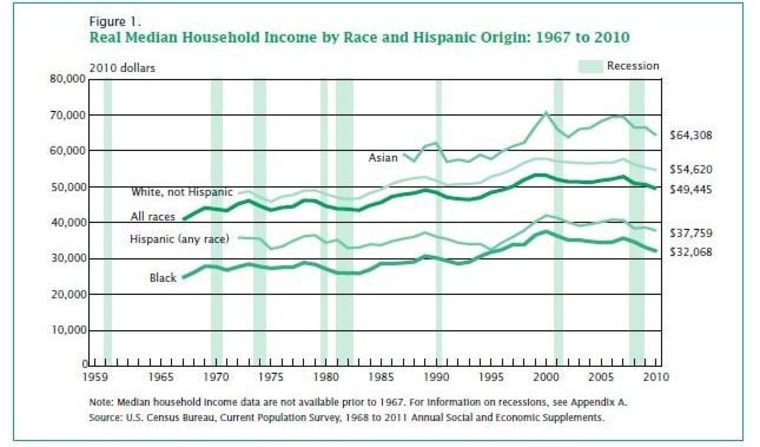

Many feel like they are treading water — and for good reason. After adjusting for inflation, the nation's median income has fallen about 7 percent from its peak in 1999, reversing a fairly steady increase that lasted for five decades from 1950, according to Census Bureau figures.

The troubles started when the nation last fell into recession in 2001. From 2000 to 2007, household income was virtually stagnant, said economist Heidi Shierholz with the Economic Policy Institute.

“Even that was dramatic,” she said.

Then came the Great Recession of 2007-09 and its ugly aftermath.

From 2007 to 2010, the Census Bureau estimates that median household income fell by 6.4 percent, to $49,445, as unemployment soared to a peak of over 10 percent. (The jobless rate dropped last month to 8.6 percent — still high by historical standards although the best level in more than two years.)

Of course, median income varies a lot depending on what kind of household you live in. For families, defined as two or more related people living together, median household income was $61,544 last year. For single people, it was $29,730.

Gordon Green, a former Census official who is now a partner in Sentier Research, has been using government data to track monthly changes in American income levels.

He wasn’t too surprised to find that median income fell during the recession. After all, a deep recession combined with sharp job losses can be expected to have that effect.

But he was surprised to find that incomes have fallen even more sharply in the weak recovery period that followed the recession, even as the massive job cuts slowed.

He suspects that’s because some people held onto their jobs but saw their hours or wages cut, while others, after long periods of unemployment, were forced to take jobs that paid less than their previous positions.

Taken together, he said the median income decline from December 2007 to June 2011 "represents a significant reduction in the American standard of living.”

Even the relatively low rate of inflation that has characterized the past few years can start to add up if your income is not rising.

"Even if there’s 2 percent inflation, if they don’t get any raise that’s a 2 percent real wage drop,” Shierholz said. “That happens for a couple years, and that starts adding up to a serious decline of what you can buy with your paycheck.”

The outlook for the future remains uncertain. Diane Swonk, chief economist with Mesirow Financial, said one major problem is that even as companies start hiring again, there aren’t good systems in place to train people for work that requires skills but not a college degree. Those skilled labor jobs traditionally have represented a strong path to get into — or stay in — the middle class.

And even a college degree isn’t necessarily the guarantee of a comfortable salary that it once was.

And despite the November surprise of a sharp drop in unemployment, it could be years before enough jobs are added to bring the rate down to historical norms of 4 to 6 percent.

“Unfortunately, if there was a silver bullet to be shot it would have already been shot,” Swonk said. “We’re going to have to struggle through this time and adjust, and it’s a painful adjustment.”

Green saw a glimmer of hope in recent data that showed a slight increase in household median income to $50,257 as of September. But he said it’s too early to tell whether that’s a sign of better times, or just a fluke in the data.

To see what it’s like to literally be in the middle of the nation’s income spectrum, Life Inc. is hitting the road this week to profile Americans from all walks of life whose household income is around $50,000 a year.

We’ll be posting their profiles here and sharing our thoughts — and yours — on Twitter, Facebook and Google Plus. We also invite you to comment on our posts — but keep it civil and on topic, please!

Finally, please share your story of what it’s like to be living on about $50,000 a year here. We’ll feature some of your stories in future Life Inc. posts.

Related:

Poverty rate hits 18-year high as median income falls

Employment growth picked up speed in November

Check out our Facebook page!