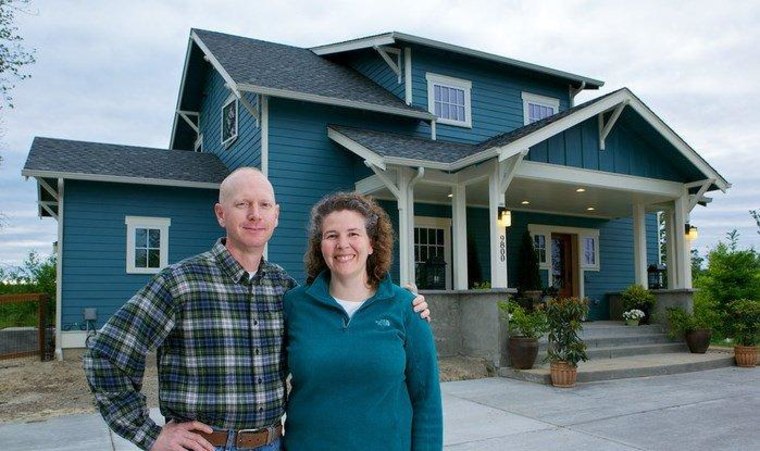

Eileen Ryan and Matt Cooper wanted their new house to be good for the environment and they were willing to pay a premium for it. They spent $350,000 to build their two-story, 2,000-square-foot energy-efficient house in Olympia, Wash., and they are happy they did.

“It costs more to build an energy-efficient house, but it costs significantly less to live in one,” Eileen explained.

Their energy bills tell the story. They pay a measly $70 a yearto heat and cool the place.

“I don’t mind paying my utility bill each month,” Matt said with a chuckle.

A new study, Home Energy Efficiency and Mortgage Risks, concludes that people who buy energy-efficient homes are 32 percent less likely to default on their mortgage than the average borrower.

They are also 25 percent less likely to prepay the loan. Underwriters consider prepayment a risk factor because the lender or investor gets less than the projected return.

“We were quite surprised by the numbers,” said Nikhil Kaza, asst. professor of city and regional planning at the University of North Carolina at Chapel Hill who worked on the study. “We thought there would be some association between energy efficiency and mortgage risk, but we did not expect such a large association.”

The study used actual loan performance data: a national sample of about 71,000 mortgages for single-family homes, both new and old, that originated between 2002 and 2012. The average sales price was $220,000, so these were not just luxury homes.

Homes with an ENERGY STAR rating were classified as energy-efficient.

Researchers accounted for variables such as size and age of the house, borrower’s credit score, local unemployment rate, neighborhood income, local weather and the price of electricity. “This is very, very powerful,” said Robert Sahadi, director of energy efficiency finance policy at the Institute for Market Transformation, the non-profit environmental group that funded this study.

The results don’t surprise Scott Bergford, owner of Scott Homes in Olympia. He built the Ryan’s home and about 300 other energy-efficient houses.

“My houses sell for a premium and in 30 years not a single buyer has defaulted,” he told me. “These are stable people who are interested in a lifestyle.”

Why the lower risk?

It could be the lower energy bills that add an extra $100 to $150 a month to the family budget. For a moderate-income buyer that’s a big deal. Or maybe the people who buy energy-efficient homes are financially well off or very prudent with their money.

Prof. Kaza told me his study didn’t look at that. He would like to see more research done to figure out why this is happening.

Related at ConsumerMan: World's greenest office building officially opens in Seattle

A call for action

Underwriters look at factors such as debt-to-income ratio, credit scores, loan-to-value ratios and reserves in the bank when their consider a loan application and decide the interest rate.

The Institute for Market Transformation (IMT) would like to see underwriters required to consider a home’s expected energy use. The report calls on the FHA, Freddie Mac and Fannie Mae to “encourage underwriting flexibility” for mortgages on energy-efficient homes.

“Now we have data that shows a home’s energy efficiency could be a positive factor for borrowers,” IMT’s Sahadi said. “We’ve come out of this underwriting crisis and now we’re looking ahead to the next 10 years and what will be the things that could be factors in underwriting performance and we’re offering energy efficiency as one of them.”

A spokesman for FHA told NBC News they knew about the IMT study but weren’t ready to comment on it.

The report suggests that if lenders did consider energy efficiency, they might want to require an energy audit or energy rating on the structure, just as they now require appraisals to calculate the value of the home.

Home builders believe such a change would result in more green homes being built, which would be good for the industry and the environment.

“It lends credence to the notion that we need to be more proactive about lending strategies, mortgage products and appraisal techniques that acknowledge the inherent value of energy efficient homes,” said Kevin Morrow, director of energy and green building at the National Association of Homebuilders.

Environmental groups point out that household energy use accounts for 20 percent of America’s total energy consumption.

Herb Weisbaum is The ConsumerMan. Follow him on Facebook and Twitter or visit The ConsumerMan website.