Who doesn't want to save more money? And with this plan, it's never been easier!

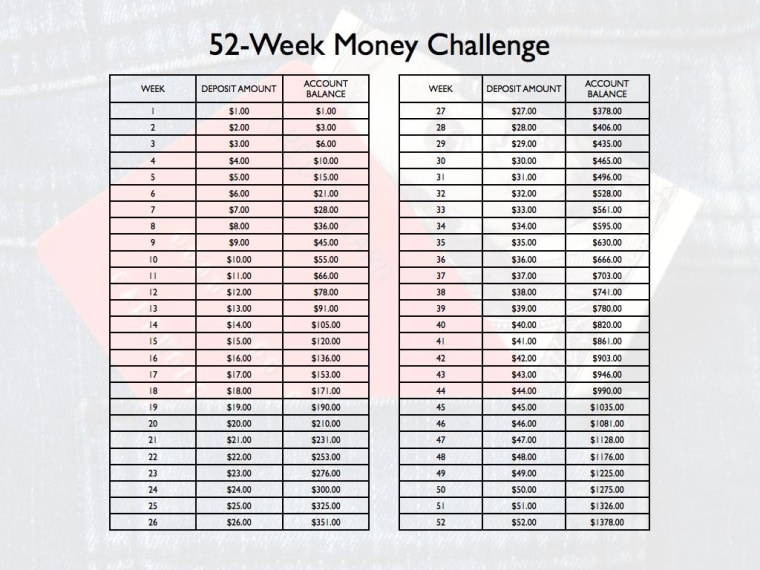

I kicked off this 52-week savings challenge on TODAY in January, so if you joined back then, right now you’re at the point where you should start feeling pretty good about the amount of money you’re putting away. If you haven't started yet, it's not too late to catch up! We're in the 9th week of 2015, so at this point you should have put aside $45 to play along.

Get the easiest plan to save money in 2015: It starts with just $1

The first few weeks were more about getting in the habit of saving, and now the money starts adding up. Once you’re kicking in double digit savings each week, the process goes even faster. Remember, you’re going to have almost $1,400 — $1,400! — by the end of the year.

Read on for some tips and tricks to help your savings stack up, like the surprising way chewing gum can help you save:

1. Saving money makes you happy!

Start visiting your savings once a week. There are few things better for your financial health than deciding to become a saver. Unfortunately, saving money isn’t necessarily fun — that’s why many people just don’t do it. But having money saved is fun — and just might make you happier. Thirty-eight percent of people who have savings accounts report feeling extremely, or very happy, compared with 29 percent of people who don’t, according to research from Ally Bank. The research also shows that the more you save, the more likely you are to be happier, and that, overall, saving money can affect happiness more than your income. It’s also easier for you to control.

2. Chew gum in the grocery store. Or, wear headphones.

What?! It's true: Both of these things are likely to reduce the amount of money you drop in the checkout line. Stores have a number of tricks that they use to get you to buy more; they pump great smelling scents (fresh-baked bread near the bakery, anyone?) to get you salivating and play music designed to make you feel so comfortable you want to stay in the store even longer. The longer you stay, the more you spend. Gum and headphones are your defenses! Coupled with the ultimate defense — a shopping list that you stick to — you should be able to spend less and save more.

3. Stop spending your $5 bills.

A member of the TODAY crew shared his family’s savings tip with me, and I think it’s so brilliant I wanted to share it with you. Save every $5 dollar bill. That’s it. Every time they get a $5 — in change from the store — they pull it out of their respective wallets and stick it in an envelope. By the end of the year, they have hundreds of dollars! This could fund your savings for weeks to come. Is it a bit of a hack? A mindgame? Sure, but so are many of these tips. The idea is to figure out the way to save that works for you. Personally, I’m a fan.

4. Time is money: How many hours did it take to earn that purchase?

By this time in the year, you're in the double digits of this savings plan. Now, whenever you buy something that’s a "want" rather than a "need," I want you to start to think about it in terms of how long you had to work to buy it. How many hours did you put in to buy that pair of blue jeans, that video game for your kids, that mediocre dinner out?

And if you’re not sure how much you earn per hour, that is definitely a number you want to have at your disposal. Here’s a shortcut to figure it out: Take the amount of money you earn in thousands per year and lop off the last three zeroes. Then divide by two. So, if you earn $60,000, it becomes $60, divided by two is $30. You earn $30 per hour. Those jeans could cost 3 hours, the dinner out even more. Is it worth it? Chances are you now have an entirely new perspective.

5. Put your tax refund to work

More than $3,500: That’s the average size of a tax refund for 2015. But the fact is, 8 out of 10 filers will get a refund. You could fulfill your entire savings challenge for the year by using a portion of your refund to satisfy your commitment! Whether you like that idea or not, a windfall like this is a chance to sock away substantial savings all at once. Don’t blow it.

6. Bring your goals to the dinner table

Involve your family and friends in your savings quest. The next time you’re all together, talk about the fact that you’re trying to save a little more this year. Then ask your spouse, the kids or your friends for ideas on how to supercharge your savings efforts.

And if you find an idea you’re willing to adopt, I want to know about it as well! Drop me a note on Twitter or by email at jean@jeanchatzky.com to let me know how it's going!