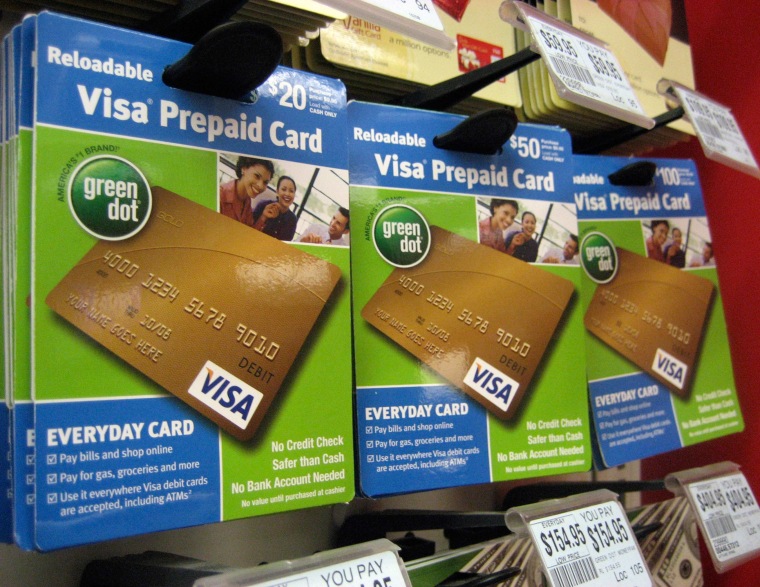

Prepaid cards are exploding in popularity but some are profiting on hidden fees and murky rules. So the government's biggest consumer watchdog is proposing some rules to get the industry in line.

Unlike a credit card, these cards are loaded with funds by a consumer, employer, a government agency, or another third party. The amount loaded on general purpose reloadable prepaid cards increased from $19.5 billion in 2008 to an estimated $98.6 billion this year, according to Mercator Advisory Group. JPMorgan Chase, U.S. Bank and American Express are all active in the business.

Many prepaid cards users are people without bank accounts or who can't get credit, but some consumers also find them useful for sticking to a budget. Parents sometimes give teens or college-age children prepaid cards so they can keep tabs on where they are spending money

The new rules are designed to clear up some confusion in the burgeoning prepaid card market.

"Our proposal would close the loopholes in this market and ensure prepaid consumers are protected whether they are swiping a card, scanning their smartphone, or sending a payment," Consumer Financial Protection Bureau (CFPB) Director Richard Cordray said in a statement released Thursday.

A number of federal regulatory agencies have applied rules to certain types of issuers or cards, but the regulation of the industry has been piecemeal. "The agencies themselves have not been coherent in the way they have looked at prepaid cards," said Ben Jackson, director of Mercator's prepaid advisory service.

Jackson warned that if the new rules create "a situation where the regulators are inflexible and require a lot of effort on the part of providers to meet needs that the customers don't have, then the regulations will be harmful." But he said a clearer set of rules could reduce uncertainty in the prepaid card market.

The CFPB's proposed rules would address several aspects of card usage. For example, all prepaid card issuers are not currently required to provide regular account statements, but the new rules would call for online statements to be issued.

The new measures would also limit consumers' exposure if their card is lost, stolen, or fraudulently used. Right now, consumers have such protections for their credit cards, but not for prepaid cards.

The rules would also establish ways for consumers to work with card issuers to resolve any errors on their accounts.

New "Know Before You Owe" disclosures would show the fees associated with prepaid cards in a systematic way. As the rules stand now, there are no universal requirements for how card issuers disclose their fees, making it hard for consumers to comparison shop.

The bureau is also proposing protections for consumers who have set up prepaid card accounts that let them pay more than they have loaded on the cards. Some issuers of these cards use the next funds the consumer loads on the card to pay off the overdraft and any associated fees. The bureau proposes forcing these card issuers to follow the same practices as credit card companies.

The prepaid card issuers currently "don't comply with credit card laws, but of course it is credit," said Lauren Saunders, associate director of the National Consumer Law Center.

"Prepaid cards fill an important niche to help consumers who have had trouble with bank accounts or just want to control spending," she said. They can also be a useful way for employers to pay employees who do not have bank accounts. "They can be very useful and convenient for consumers, but right now the protections are uncertain and there are abusive practices on some cards." The new protections, she said, "will give consumers and employers more confidence."

The proposed rules will be open for comment for 90 days after they are published in the Federal Register.