Americans are still keeping a tight grip on their wallets, bypassing vacations and dinners out, even though they feel better about their own financial security.

What’s still spooking U.S. consumers? Gas prices.

Even though gas prices have been declining for several months, nearly six in 10 consumers say they’ve cut back on nonessential spending because of hefty fuel prices, according to a study released Monday by Bankrate.com.

“Gas prices are still a drag on people’s spending power,” said Greg McBride, Bankrate’s senior financial analyst.

According to AAA, the national average price for regular unleaded fuel declined to $3.689 a gallon, down from $3.871 a gallon last month, and below the average prices of $3.867 a year ago.

“Despite the drop in recent weeks, gas prices are still at elevated levels,” he continued. This at a time, he pointed out, “when so many households are dealing with stagnant incomes.”

But there’s good news in the Bankrate.com report. Consumers are feeling pretty okay about their job security and their debt loads.

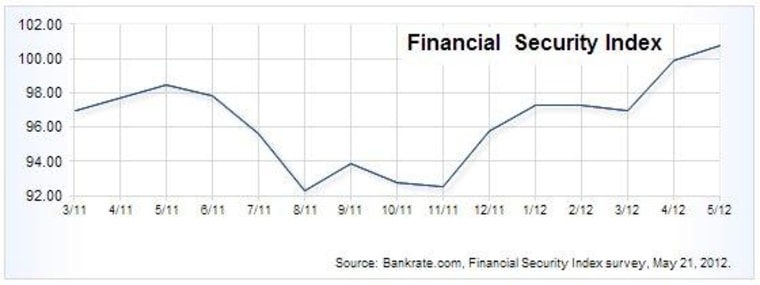

For the first time since December 2010, Bankrate’s Financial Security Index -- which tracks how consumer gauge there overall economic health -- passed the 100 threshold, which shows that Americans see an improvement in their financial security.

“We’ve seen improvement on multiple fronts,” McBride maintained. “People are feeling more secure in their jobs, they feel better about their debt burdens, and they’re reporting lower net worth with less frequency.”

The main reason for the optimism, he noted, was the stabilizing of home prices throughout many town across the country. “When people see home prices sliding they can see their net worth declining, but when they rise, all of a sudden they feel better about their net worth.”

So the wild card, he added, are gas prices. If they start to decline further, “that’s going to breath some life into household budgets and they’ll have more money to spend.”

And it may take off before the job market gets more robust.

“While hiring has not exactly taken off, downsizing activity remains relatively low and many employers are actually worried about losing talent," maintained John Challenger, CEO of outplacement firm Challenger, Gray & Christmas. "This is not to say that job security has returned to pre-recession levels, but workers certainly are enjoying more security than two years ago."

What’s your take? Have you decided to cut back on nights out at the movies, or Memorial Day travel because of gas prices? Do you feel more secure about you job?