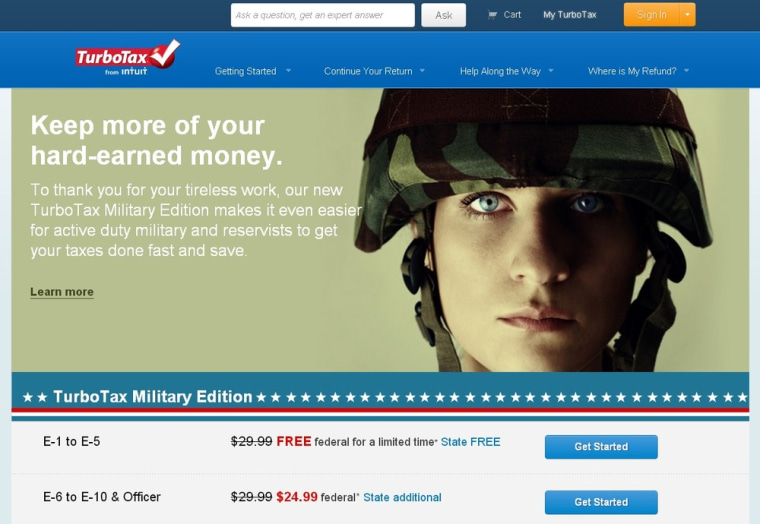

Military families have special challenges with their finances and that includes tax preparation. TurboTax has just released a new version of its tax preparation software created specifically for military filers. For a limited time, it’s free for junior enlisted personnel.

“TurboTax Military Edition was created by active reserve and retired military personnel and military spouses, and they really understand the unique challenges of filing taxes when you’re in the military,” explained spokeswoman Julie Miller. “There are more than two million military taxpayers, and because they have a unique set of needs, we realized that we had to have a more personalized product that met those needs.”

TurboTax Military Edition gives step-by-step guidance to help service members claim every deduction and credit they’re entitled to, so they can keep more of their hard-earned money. This includes determining state of residency, filing in multiple states, deductions for relocation expenses and uniforms, combat pay, and what to do if you have a PCS (permanent change of station).

“It speaks their language,” Miller said. “It uses the terms they’re familiar with to make it easier for them.”

TurboTax will be fully up to date with the new tax laws by early next week, Miller said. From now through Feb. 14, this software is free for junior enlisted personnel (rank E-1 to E-5) in any branch of the Armed Forces. It’s also available during this time period for $24.95 (a $5 discount) for anyone ranked E-6 through officer.

Every military member using this TurboTax software, even the free version, can get one-on-one advice via phone or chat from one of the company’s tax experts.

Intuit, the parent company of TurboTax, also has joined with Operation Homefront to help military members who need financial support and assistance.

Through a joint fundraising effort called Mission2Match, Intuit will match up to $1 million in donations made to Operation Homefront through April 15, 2013. TurboTax customers can donate as part of their online tax preparation.

“We are asking our customers to join us and give generously to support U.S. servicemen and women and their families,” Dan Maurer, an Intuit senior vice president, said in a statement.

Donations are also being accepted on the TurboTax Facebook page and YouTube channel. Only donations made through this Mission2Match program are eligible for the company’s match. Donations will be matched a second time if donors tweet about the fundraising effort (#mission2match).

“We’ve found that many people want to support our service members, but don’t always know how,” said Jim Knotts, president and chief executive officer of Operation Homefront in a statement. “By combining their technology and huge public reach, TurboTax is giving their customers the opportunity to provide that support exactly when it is most on their minds.”

Herb Weisbaum is The ConsumerMan. Follow him on Facebook and Twitteror visit The ConsumerMan website.

More money news: