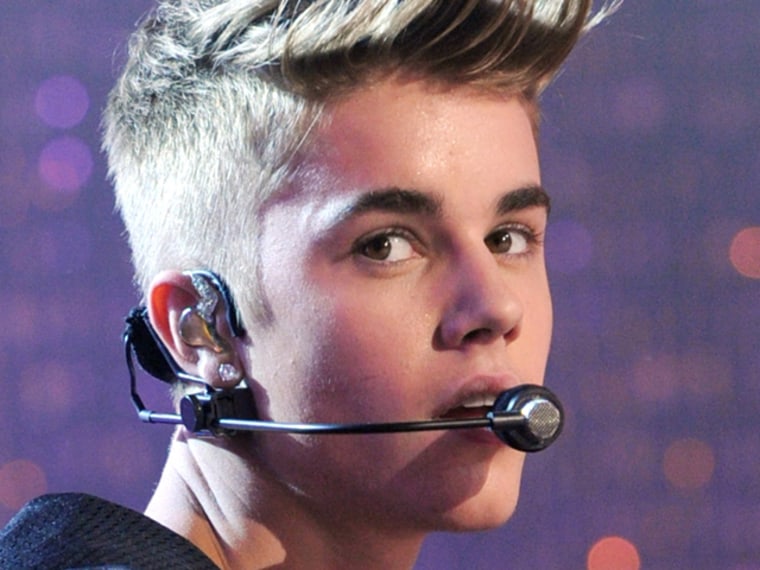

If Justin Bieber endorses a product, will teens buy it or convince their parents to get it for them? BillMyParents, a financial services company focused on teens, is banking on it. They’ve signed a deal with the pop star to endorse a new prepaid debit card to his legions of loyal fans.

With 50 million Facebook fans and more than 32 million followers on Twitter, Bieber has enormous marketing power. As a “brand ambassador” for the SpendSmart card, the 18-year old performer will promote the card via social media and develop a series of videos that will promote responsible spending.

“By combining our new teen prepaid debit card with Justin's vast reach and financial educational materials, we can empower countless families with teens to think about responsible spending in a new and better way,” said Mike McCoy, chairman and CEO of BillMyParents in a news release.

Beiber will become the face of a new version of the SpendSmart card. BillMyParents has not announced a launch date for when that marketing campaign will begin, but its public relations firm said it should happen in a couple of weeks. At that time, the SpendSmart card will get a new design, but the product features and pricing will stay the same.

SpendSmart is a prepaid debit card that can be used anywhere MasterCard is accepted. Like most prepaid cards, it has a long list of fees:

- Monthly fee: $3.95

- Loading charge $0.75 to add money from a checking or savings account; $2.95 from a credit or debit card

- ATM charge: $1.50 per withdrawal; $0.50 per balance inquiry

- Inactivity fee: $3 if the card is not used for 90 days

- Replacement fee: $7.95 if the card is lost

Is this card right for your teen?

“The good thing about a prepaid debit card is that you cannot go into debt,” noted Gerri Detweiler, personal finance expert at credit.com. “You can only spend what’s on the card, so for that reason it’s a great way to manage an allowance.”

And this Bieb-endorsed prepaid card gives parents maximum control. They can sign up for text alerts every time the card is used or download a smart phone app that makes it easy to track the balance and see individual purchases. Parents can also temporarily freeze the card if they don’t like how the money is being spent and permanently block it from being used at some retailers.

But there are other factors to consider.

Bill Hardekopf, CEO of lowcards.com, doesn’t like most prepaid cards in general and questions the educational value of this card.

“I’m not sure a prepaid debit card really teaches financial responsibility,” Hardekopf said. “I don’t know if this is the right way to go for a young person.”

John Ulzheimer, president of consumer education at SmartCredit.com, points to that monthly fee, which adds up to $47 a year. He doesn’t like the idea of teaching teens it’s smart to pay a fee to use your own money.

“That’s a very dangerous message to send a young person who is basically at the beginning of their consumer credit lifecycle,” he said.

Ulzheimer said it makes sense to pay an annual fee of $50 to have a credit card with a $25,000 limit because it gives you access to someone else’s money. But he said it is “unreasonable” to pay almost that much for a debit card where no credit is extended.

Financial experts point out that prepaid debit cards do nothing to create a credit history or build a credit score because these transactions are not reported to the credit reporting agencies. To do that, you’d need to get your child a low-limit credit card, something you can control as the co-signer.

“I like the idea of giving a young person a credit card with limits on it,” Ulzheimer said. “It’s almost like a credit card with training wheels. And teach them the proper way to use it, so when they’re out on their own they understand there’s a right way and a wrong way to manage credit.”

The hot new plastic

Demand for prepaid debit cards is skyrocketing. According to the Mercator Advisory Group, $57 billion was loaded onto these cards in 2011. That’s expected to top $168 billion by 2015.

These cards are popular with people who don’t have or don’t want a bank account or who can’t get or don’t want to use a credit card. They’re endorsed by big name celebrities, such as Suze Orman, Magic Johnson, LilWayne, Russell Simmons, Alex Rodriguez, and George Lopez. And who can forget the Kardashian Kard, launched in 2010, with fees so high it was quickly pulled off the market?

Right now, there are no government regulations on prepaid card fees, so the companies that issue them can charge whatever they want.

The bottom line

The SpendSmart card is less expensive than some prepaid debit cards on the market. And it does have some nice parental control features. But there are money-saving alternatives.

The new Bluebirdcard from American Express and sold by Wal-Mart, can be used fee-free if you stick to in-network cash machines.

The Chase Liquid prepaid Visa debit card is another good choice. It has a flat monthly fee of $4.95.

The Kaiku Visaprepaid card is free – there’s no cost to get it. The monthly fee is only $1.95 and you can use any of the 50,000 ATMs in the Allpoint network for free.

And there’s always a conventional debit card that’s linked to a checking account. It can be used fee-free, aside from any bank charges for the checking account.

“Maybe the lesson to teach your kids is that just because it has a celebrity name on it, doesn’t necessarily mean it’s the best product for you,” said financial expert Gerri Detweiler.

More information:

- Consumer Reports: Prepaid Cards: Plastic That’s Less Than Fantastic

- Bankrate: Pros & Cons of Prepaid Debit Cards

- SmartCredit: Why Isn’t My Prepaid Debit Card on My Credit Report?

- ConsumerMan: The Truth Behind Suze Orman’s New Debit Card

- ConsumerMan: Prepaid Cards Might Not Be So Bad for Those Who Overdraft

Herb Weisbaum is The ConsumerMan. Follow him on Facebook and Twitteror visit The ConsumerMan website.